|

|

Nelson Aldrich » Nelson Aldrich »

Clarence Barron » Clarence Barron »

Alfred Owen Crozier » Alfred Owen Crozier »

Elbert H. Gary » Elbert H. Gary »

Thomas W. Lamont » Thomas W. Lamont »

Charles Lindbergh » Charles Lindbergh »

McClure’s Magazine » McClure’s Magazine »

John Pierpont Morgan » John Pierpont Morgan »

Adolph Ochs » Adolph Ochs »

Charles M. Schwab » Charles M. Schwab »

Ida Tarbell » Ida Tarbell »

Samuel Untermyer » Samuel Untermyer »

Paul Warburg » Paul Warburg »

Woodrow Wilson » Woodrow Wilson »

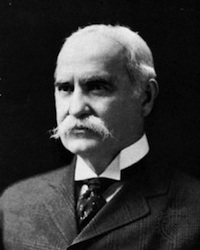

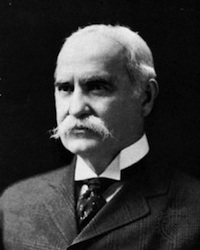

Nelson Aldrich

Powerful senator from Rhode Island who served Congress from 1881-1911. Aldrich headed the Senate Finance Committee for many years as well, working to install a series of tariffs to promote American manufacturing. A deep proponent of European central banking practices, Aldrich worked extensively with Paul M. Warburg to draw support for the namesake Aldrich Bill, which later became the Federal Reserve Act signed into law in 1913. His daughter, Abby, married John D. Rockefeller. Powerful senator from Rhode Island who served Congress from 1881-1911. Aldrich headed the Senate Finance Committee for many years as well, working to install a series of tariffs to promote American manufacturing. A deep proponent of European central banking practices, Aldrich worked extensively with Paul M. Warburg to draw support for the namesake Aldrich Bill, which later became the Federal Reserve Act signed into law in 1913. His daughter, Abby, married John D. Rockefeller.

Clarence Barron

As anti-business sentiment mounted after the Panic of 1907, Clarence Barron—publisher of the Wall Street Journal—used his frequent opinion pieces to lambast proposals of new government regulations. He heralded J.P. Morgan as “the nation’s Prometheus” and asserted that the era’s most powerful tycoons were performing divine work—not unlike Goldman Sachs CEO Lloyd C. Blankfein. The Wall Street Journal under his rule delivered frequent but often uncritical news about financial institutions. Much of the paper's financial advertising was placed there in order to buy the newspaper’s silence, according to William Peter Hamilton, a future editor of the Wall Street Journal. As anti-business sentiment mounted after the Panic of 1907, Clarence Barron—publisher of the Wall Street Journal—used his frequent opinion pieces to lambast proposals of new government regulations. He heralded J.P. Morgan as “the nation’s Prometheus” and asserted that the era’s most powerful tycoons were performing divine work—not unlike Goldman Sachs CEO Lloyd C. Blankfein. The Wall Street Journal under his rule delivered frequent but often uncritical news about financial institutions. Much of the paper's financial advertising was placed there in order to buy the newspaper’s silence, according to William Peter Hamilton, a future editor of the Wall Street Journal.

One editorial he wrote in 1921 is excerpted here.

“Capitalism—the sacred notion of free men and free markets—has enabled our economy to ascend from the third circle of Hell to Halcyon prosperity in fifty short years. But rather than continue the system exactly as is, there are those who would have the government intervene and control Wall Street, as if it were more illegal gamble than legitimate risk…. Like Moscow’s new leaders, these people don’t understand the cornerstones of free enterprise, supply and demand.

“To the underutilized officials pursuing the regulation of our financial markets, we say, seek some other cause to get reelected or promoted.”

Alfred Owen Crozier

Prominent Midwestern attorney who wrote widely against the power and influence held by Wall Street Bankers. Crozier wrote eight books, including The Magnet and U.S. Money vs. Corporation Currency, which served to warn the country of the replacement of the country’s currency by notes printed by private firms.

Elbert H. Gary

Although not the first president of the United States Steel Corporation, Elbert H. Gary was the most famous and influential. Born in 1846 to a middle class family in Illinois, Gary began his career as a lawyer, only entering the steel industry after meeting J. Pierpont Morgan in 1898. Unlike Charles Schwab, Gary began his steel career in a management position, but he had comparable business talents and became equally reputable in the industry. Gary set himself apart from many other steel executives by always practicing scrupulous honesty and fairness, earning himself the nickname "The Judge." But this did not prevent him from being a fierce and ruthless adversary to competitors. His decency also did not prevent him from being wildly successful, earning many millions at U.S. Steel. An early adherent to bonus systems, Gary developed the Stock Subscription and Profit Sharing Plan for his employees, helping to set an industry standard for decades to come. Never one to slack off or step down, Gary was still serving as chairman of the board of U.S. Steel at his unexpected death in 1927 at the age of 82. Although not the first president of the United States Steel Corporation, Elbert H. Gary was the most famous and influential. Born in 1846 to a middle class family in Illinois, Gary began his career as a lawyer, only entering the steel industry after meeting J. Pierpont Morgan in 1898. Unlike Charles Schwab, Gary began his steel career in a management position, but he had comparable business talents and became equally reputable in the industry. Gary set himself apart from many other steel executives by always practicing scrupulous honesty and fairness, earning himself the nickname "The Judge." But this did not prevent him from being a fierce and ruthless adversary to competitors. His decency also did not prevent him from being wildly successful, earning many millions at U.S. Steel. An early adherent to bonus systems, Gary developed the Stock Subscription and Profit Sharing Plan for his employees, helping to set an industry standard for decades to come. Never one to slack off or step down, Gary was still serving as chairman of the board of U.S. Steel at his unexpected death in 1927 at the age of 82.

Thomas W. Lamont

Thomas W. Lamont (September 30, 1870 – February 2, 1948) was a partner at J.P.Morgan & Co until 1943 when he became Chairman of the board. His personal papers, held at the Baker Library at the Harvard Business School, serve to defend J. Pierpont's role in the financial crisis in 1907 though most of his letters are unpublished. He speaks directly to Ida Tarbell's "Hunt For a Money Trust" and argues that the article “clearly shows the entire failure of critics to comprehend the point of view of the banking and business world”. He criticized Tarbell and other muckrakers for inaccurate reporting that "garbled" the words and testimony of J.Pierpont Morgan and other financiers at the Pujo hearings. Thomas W. Lamont (September 30, 1870 – February 2, 1948) was a partner at J.P.Morgan & Co until 1943 when he became Chairman of the board. His personal papers, held at the Baker Library at the Harvard Business School, serve to defend J. Pierpont's role in the financial crisis in 1907 though most of his letters are unpublished. He speaks directly to Ida Tarbell's "Hunt For a Money Trust" and argues that the article “clearly shows the entire failure of critics to comprehend the point of view of the banking and business world”. He criticized Tarbell and other muckrakers for inaccurate reporting that "garbled" the words and testimony of J.Pierpont Morgan and other financiers at the Pujo hearings.

Charles Lindbergh

Charles Lindbergh (January 20, 1859 – May 24, 1924), the father of the famous aviator, was a member of the House of Representatives from Minnesota and the radical leader of the progressive Republicans within Congress. It was Lindbergh that began to stir up the “hue and cry” of the Money Trust Hunt in December of 1911, leading to the Pujo Committee investigation. As a vocal opponent of financial barons and money trusts, he wrote Banking and Currency and the Money Trust in 1913. In his book, he encouraged the general public to stand up and act against the banker class, led by J.Pierpont Morgan. Charles Lindbergh (January 20, 1859 – May 24, 1924), the father of the famous aviator, was a member of the House of Representatives from Minnesota and the radical leader of the progressive Republicans within Congress. It was Lindbergh that began to stir up the “hue and cry” of the Money Trust Hunt in December of 1911, leading to the Pujo Committee investigation. As a vocal opponent of financial barons and money trusts, he wrote Banking and Currency and the Money Trust in 1913. In his book, he encouraged the general public to stand up and act against the banker class, led by J.Pierpont Morgan.

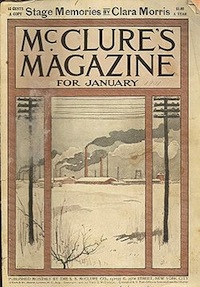

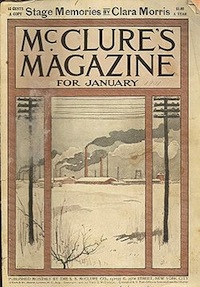

McClure’s Magazine

McClure's Magazine was an American monthly founded by S.S. McClure and John Sanborn Phillips in June, 1893. It was popular at the turn of the 20th century, featuring political and literary content. The magazine is credited with creating muckraking journalism. As noted in the New York Times book review "Society in Fiction" on March 30, 1913, the Sixty-First Second is a detective story regarding the highest circles of the high in New York city” including the influences of J. Pierpont Morgan during the 1907 crisis. It was published as part of a series in McClure's magazine in 1912 by Owen Johnson. Throughout the book, there are allusions to the Panic of 1907. McClure's Magazine was an American monthly founded by S.S. McClure and John Sanborn Phillips in June, 1893. It was popular at the turn of the 20th century, featuring political and literary content. The magazine is credited with creating muckraking journalism. As noted in the New York Times book review "Society in Fiction" on March 30, 1913, the Sixty-First Second is a detective story regarding the highest circles of the high in New York city” including the influences of J. Pierpont Morgan during the 1907 crisis. It was published as part of a series in McClure's magazine in 1912 by Owen Johnson. Throughout the book, there are allusions to the Panic of 1907.

John Pierpont Morgan

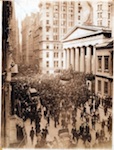

John Pierpont Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker who dominated corporate finance and industrial consolidation during his time. J.P. Morgan & Co. was founded in New York in 1871 as Drexel, Morgan & Co. by J. Pierpont Morgan and Philadelphia banker Anthony J. Drexel, which was named J. P. Morgan & Company in 1895. In bailing out the New York Stock Exchange, the Brokerage House Moore & Schley, Knickerbocker Trust Company, and Tennessee Coal & Iron Railroad Company, Morgan lost $21 million. Though he played a critical role in orchestrating the bail-out of many institutions during the crisis among other financiers at the time, he faced public criticism shortly afterwards. Along with other financial barons of the time, he was investigated in 1912 by the Pujo Committee. John Pierpont Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker who dominated corporate finance and industrial consolidation during his time. J.P. Morgan & Co. was founded in New York in 1871 as Drexel, Morgan & Co. by J. Pierpont Morgan and Philadelphia banker Anthony J. Drexel, which was named J. P. Morgan & Company in 1895. In bailing out the New York Stock Exchange, the Brokerage House Moore & Schley, Knickerbocker Trust Company, and Tennessee Coal & Iron Railroad Company, Morgan lost $21 million. Though he played a critical role in orchestrating the bail-out of many institutions during the crisis among other financiers at the time, he faced public criticism shortly afterwards. Along with other financial barons of the time, he was investigated in 1912 by the Pujo Committee.

Adolph Ochs

Under Adolph Ochs' leadership, The New York Times sought to provide impartial news—a radical undertaking in an era of yellow journalism—while also appealing to the political and business establishment. Ochs, an ambitious small-town newspaper publisher from Tennessee, purchased The Times when it was financially failing in 1896 for $75,000, almost entirely funded by loans from Wall Street investors ($25,000 alone came from J.P. Morgan). As he expanded the paper's news operation, he became even more indebted to investors. A conservative Democrat, Ochs valued his business contacts. However, his mission to deliver the news impartially sometimes conflicted with his desire to not alienate the elite that he had worked so tirelessly to join. During the Panic of 1907, The Times vividly portrayed the human side of the crisis as it unfolded. While it was clear that investors faced contingencies beyond their control, Times articles portrayed investors as exercising significant agency in their financial decisions. Under Adolph Ochs' leadership, The New York Times sought to provide impartial news—a radical undertaking in an era of yellow journalism—while also appealing to the political and business establishment. Ochs, an ambitious small-town newspaper publisher from Tennessee, purchased The Times when it was financially failing in 1896 for $75,000, almost entirely funded by loans from Wall Street investors ($25,000 alone came from J.P. Morgan). As he expanded the paper's news operation, he became even more indebted to investors. A conservative Democrat, Ochs valued his business contacts. However, his mission to deliver the news impartially sometimes conflicted with his desire to not alienate the elite that he had worked so tirelessly to join. During the Panic of 1907, The Times vividly portrayed the human side of the crisis as it unfolded. While it was clear that investors faced contingencies beyond their control, Times articles portrayed investors as exercising significant agency in their financial decisions.

The Times’ mission statement as Ochs articulated it can be read here.

“It will be my earnest aim that The New York Times give the news, all the news, in concise and attractive form, in language that is parliamentary in good society, and give it as early, if not earlier, than it can be learned through any other reliable medium; to give the news impartially, without fear or favor, regardless of any party, sect, or interest involved; to make the columns of The New York Times a forum for the consideration of all questions of public importance, and to that end to invite intelligent discussion from all shades of opinion.”

Charles M. Schwab

Born in Pennsylvania in 1862 to a family of modest means, Charles M. Schwab started out as a laborer in one of Andrew Carnegie's steel mills and rapidly worked his way to the top of the industry, eventually becoming president of the United States Steel Corporation in 1901 and a close friend and business partner of Carnegie. Schwab is most famous for his leadership of the Bethlehem Steel Corporation beginning in 1903, during which time he brought the company from the brink of bankruptcy to being one of the largest and most profitable steel companies in the world. Schwab was a shrewd and masterful businessman, as well as infamous for his gambling antics in Monte Carlo. Schwab ruthlessly suppressed union activity and labor movements in his plants, but was also an early pioneer of the bonus system, giving even laborers financial rewards for exemplary work. Many people attribute much of the success of Bethlehem Steel to Schwab's bonus system, although it came under fire in the 1930s when the public discovered that company executives, including Schwab, were also benefiting from the bonus system––in the form of million dollar salaries and bonuses, setting precedents for other CEOs in decades to come. Hit hard by the stock market crash of 1929, Schwab died bankrupt in 1939, but his legacy in the steel world and beyond would not be forgotten. Born in Pennsylvania in 1862 to a family of modest means, Charles M. Schwab started out as a laborer in one of Andrew Carnegie's steel mills and rapidly worked his way to the top of the industry, eventually becoming president of the United States Steel Corporation in 1901 and a close friend and business partner of Carnegie. Schwab is most famous for his leadership of the Bethlehem Steel Corporation beginning in 1903, during which time he brought the company from the brink of bankruptcy to being one of the largest and most profitable steel companies in the world. Schwab was a shrewd and masterful businessman, as well as infamous for his gambling antics in Monte Carlo. Schwab ruthlessly suppressed union activity and labor movements in his plants, but was also an early pioneer of the bonus system, giving even laborers financial rewards for exemplary work. Many people attribute much of the success of Bethlehem Steel to Schwab's bonus system, although it came under fire in the 1930s when the public discovered that company executives, including Schwab, were also benefiting from the bonus system––in the form of million dollar salaries and bonuses, setting precedents for other CEOs in decades to come. Hit hard by the stock market crash of 1929, Schwab died bankrupt in 1939, but his legacy in the steel world and beyond would not be forgotten.

Ida Tarbell

Ida M. Tarbell (November 6, 1857 – January 6, 1944) was known as one of the leading “muckrakers” of her day. Earlier in her career she worked for McClure’s Magazine and published the controverisal book in 1904 The History of the Standard Oil Company, which was a negative expose of J.D. Rockefellar. She continued to pursue muckraking journalism, publishing "The Hunt For A Money Trust” in 1913 in The American Magazine. Ida M. Tarbell (November 6, 1857 – January 6, 1944) was known as one of the leading “muckrakers” of her day. Earlier in her career she worked for McClure’s Magazine and published the controverisal book in 1904 The History of the Standard Oil Company, which was a negative expose of J.D. Rockefellar. She continued to pursue muckraking journalism, publishing "The Hunt For A Money Trust” in 1913 in The American Magazine.

The motivation behind this article was to de-mystify the Pujo investigation and put provide a comprehensive chain of events that the average person could understand. She argued that the current financial system placed too much power in the hands of a small group of bankers that were out of touch with the average American.

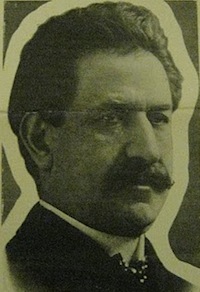

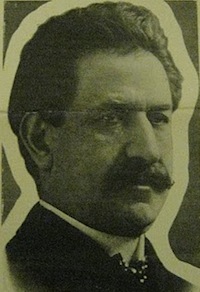

Samuel Untermyer

Samuel Untermyer (March 6, 1858 – March 16, 1940) was a Democrat lawyer known most notably as the Congressional investigator during the Pujo Committee Hearings. In 1911 he delivered an address entitled, "Is There a Money Trust?" which led to an investigation by the Committee on Banking and Currency of the U.S. House of Representatives headed by Arsène Pujo the following year. From 1912 to 1913 he led the Pujo Committee to investigate financial barons such as J.Pierpont Morgan and George F. Baker. Untermyer argued for the regulation of the American financial system, specifically that of money trusts. Samuel Untermyer (March 6, 1858 – March 16, 1940) was a Democrat lawyer known most notably as the Congressional investigator during the Pujo Committee Hearings. In 1911 he delivered an address entitled, "Is There a Money Trust?" which led to an investigation by the Committee on Banking and Currency of the U.S. House of Representatives headed by Arsène Pujo the following year. From 1912 to 1913 he led the Pujo Committee to investigate financial barons such as J.Pierpont Morgan and George F. Baker. Untermyer argued for the regulation of the American financial system, specifically that of money trusts.

Paul Warburg

Originally born in Germany to a prominent banking family, Paul Warburg settled in the United States following his marriage to Nina Loeb, daughter of a founder of Kuhn, Loeb & Company, a prominent New York-based investment bank. Warburg gained further renown through his numerous writings in support of a central banking system in the United States, beginning as early as 1907 with “Plan for a Modified Central Bank,” which was published shortly after the Panic of 1907. Warburg largely masterminded the Aldrich Bill, the blueprint of the 1913 Federal Reserve Act, as well as the creation of the National Citizens’ League to garner popular support for banking reform. Originally born in Germany to a prominent banking family, Paul Warburg settled in the United States following his marriage to Nina Loeb, daughter of a founder of Kuhn, Loeb & Company, a prominent New York-based investment bank. Warburg gained further renown through his numerous writings in support of a central banking system in the United States, beginning as early as 1907 with “Plan for a Modified Central Bank,” which was published shortly after the Panic of 1907. Warburg largely masterminded the Aldrich Bill, the blueprint of the 1913 Federal Reserve Act, as well as the creation of the National Citizens’ League to garner popular support for banking reform.

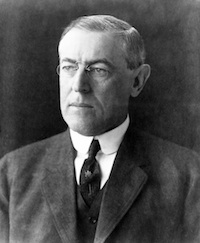

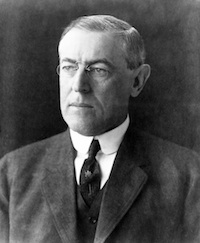

Woodrow Wilson

Although Woodrow Wilson garnered only 41.8 percent of the popular vote in the presidential election of 1912, his election was a watershed moment in American politics. After a period of Republican political dominance after the Civil War, Wilson’s election marked the beginning of the rise of Democratic politicians for the next seven decades. The Panic of 1907 helped solidify public support for new government checks on business, after Wilson implemented unprecedented economic reform. Although Woodrow Wilson garnered only 41.8 percent of the popular vote in the presidential election of 1912, his election was a watershed moment in American politics. After a period of Republican political dominance after the Civil War, Wilson’s election marked the beginning of the rise of Democratic politicians for the next seven decades. The Panic of 1907 helped solidify public support for new government checks on business, after Wilson implemented unprecedented economic reform.

He secured the passage of the Federal Reserve Act in 1913, creating the Federal Reserve as it is known today. The Federal Reserve was created largely in response to the run on the banks in the Panic of 1907, which many observers felt a central bank could have easily addressed. Wilson’s choice for the central bank to be run by a public board independent of the U.S. Treasury exemplified his role as an arbitrator between conservative Republicans and the anti-business wing of the Democratic Party. While leftists advocated for a central bank that would directly print money for the government, and conservatives opposed the idea of a government overseer of business at all, Wilson struck a balance between supporting business and providing a check on it. An advocate of fair competition, he also lowered the tariff, created a new income tax, established the Federal Trade Commission, and passed the landmark Clayton Antitrust Act, which made monopolistic practices like price discrimination illegal.

Salient quotes from Wilson's campaign speeches can be viewed here.

“Big business is no doubt to a large extent necessary and natural. The development of business upon a great scale, upon a great scale of cooperation, is inevitable, and, let me add, is probably desirable. But that is a very different matter from the development of trusts, because the trusts have not grown. They have been artificially created…” (164-165).

“As for watered stock, I know all the sophistical arguments, and they are many, for capitalizing earning capacity. It is a very attractive and interesting argument, and in some instances it is legitimately used. But there is a line you cross, above which you are not capitalizing your earning capacity, but capitalizing your control of the market, capitalizing the profits which you got by your control of the market, and didn’t get by efficiency and economy. These things are not hidden even from the layman” (171).

“[T]hey do not propose to see their control of the market interfered with by outsiders. And who are the outsiders? Why, all the rest of the people of the United States are outsiders. They are rapidly making us outsiders with respect even of the things that come from the bosom of the earth, and which belong to us in a peculiar sense” (174).

“[W]hen you reflect that the twenty-four men who control the United States Steel Corporation, for example, are either presidents or vice-presidents or directors in 55 percent of the railways of the United States, reckoning by the valuation of those railroads and the amount of their stock and bonds, you know just how close the whole thing is knitted together in our industrial system, and how great the temptation is. These twenty-four gentlemen administer that corporation as if it belonged to them. The amazing thing to me is that the people of the United States have not seen that the administration of a great business like that is not a private fair; it is a public affair” (176-177).

“A trust does not bring efficiency to the aid of business; it buys efficiency out of business. I am for big business, and I am against the trusts. Any man who can survive by his brains, any man who can put the others out of the business by making the thing cheaper to the consumer at the same time that he is increasing its intrinsic value or quality, I take my hat off to, and I say: ‘You are the man who can build up the United States, and I wish there were more of you’” (180-181).

“However it has come about, it is more important still that the control of credit also has become dangerously centralized. […] The great monopoly in this country is the monopoly of big credits. So long as that exists, our old variety and freedom and individual energy of development are out of the question” (185).

“Centralized business has built up vast structures of organization and equipment which overtop all states and seem to have no match or competitor except the federal government itself. What we have got to do,—and it is a colossal task not to be undertaken with a light head or without judgment,—what we have get to do is to disentangle this colossal ‘community of interest’” (187-188).

“I have lived in a state that was owned by a series of corporations. They handed it about. It was at one time owned by the Pennsylvania Railroad; then it was owned by the Public Service Corporation when I was admitted, and that corporation has been resentful ever since that I interfered with its tenancy. […] We liberated government in my state, and it is an interesting fact that we have not suffered one moment in prosperity” (263-265).

“Almost every monopoly that has resisted dissolution has resisted the real interests of its own stockholders. Monopoly always checks development, weighs down on natural prosperity, pulls against natural advance” (265).

“Do you know, have you had occasion to learn, that there is no hospitality for invention nowadays? […] Wherever there is monopoly, not only is there no incentive to improve, but, improvement being costly in that it ‘scraps’ old machinery and destroys the value of old products, there is a positive motive against improvement” (265-266).

“Did you never think of it,—men are cheap, and machinery is dear… You can discard your man and replace him; there are others ready to come into his place; but you can’t without great cost discard your machine and put a new one in its place…. It is time that property, as compared with humanity, should take second place, not first place. We must see to it that there is no overcrowding, that there is no bad sanitation, that there is no unnecessary spread of avoidable diseases, that the purity of food is safeguarded, that there is every precaution against accident, that women are not driven to impossible tasks, nor children permitted to spend their energy before it is fit to be spent. The hope and elasticity of the race must be preserved… What is the use of having industry, if we perish in producing it?” (275-276).

“There is going to be a general release of the capital, the enterprise, of millions of people, a general opening of the doors of opportunity. With what a spring of determination, with what a shout of jubilation, will the people rise to their emancipation!” (257-258).

|

Powerful senator from Rhode Island who served Congress from 1881-1911. Aldrich headed the Senate Finance Committee for many years as well, working to install a series of tariffs to promote American manufacturing. A deep proponent of European central banking practices, Aldrich worked extensively with Paul M. Warburg to draw support for the namesake Aldrich Bill, which later became the Federal Reserve Act signed into law in 1913. His daughter, Abby, married John D. Rockefeller.

Powerful senator from Rhode Island who served Congress from 1881-1911. Aldrich headed the Senate Finance Committee for many years as well, working to install a series of tariffs to promote American manufacturing. A deep proponent of European central banking practices, Aldrich worked extensively with Paul M. Warburg to draw support for the namesake Aldrich Bill, which later became the Federal Reserve Act signed into law in 1913. His daughter, Abby, married John D. Rockefeller. As anti-business sentiment mounted after the Panic of 1907, Clarence Barron—publisher of the Wall Street Journal—used his frequent opinion pieces to lambast proposals of new government regulations. He heralded J.P. Morgan as “the nation’s Prometheus” and asserted that the era’s most powerful tycoons were performing divine work—not unlike Goldman Sachs CEO Lloyd C. Blankfein. The Wall Street Journal under his rule delivered frequent but often uncritical news about financial institutions. Much of the paper's financial advertising was placed there in order to buy the newspaper’s silence, according to William Peter Hamilton, a future editor of the Wall Street Journal.

As anti-business sentiment mounted after the Panic of 1907, Clarence Barron—publisher of the Wall Street Journal—used his frequent opinion pieces to lambast proposals of new government regulations. He heralded J.P. Morgan as “the nation’s Prometheus” and asserted that the era’s most powerful tycoons were performing divine work—not unlike Goldman Sachs CEO Lloyd C. Blankfein. The Wall Street Journal under his rule delivered frequent but often uncritical news about financial institutions. Much of the paper's financial advertising was placed there in order to buy the newspaper’s silence, according to William Peter Hamilton, a future editor of the Wall Street Journal. Although not the first president of the United States Steel Corporation, Elbert H. Gary was the most famous and influential. Born in 1846 to a middle class family in Illinois, Gary began his career as a lawyer, only entering the steel industry after meeting J. Pierpont Morgan in 1898. Unlike Charles Schwab, Gary began his steel career in a management position, but he had comparable business talents and became equally reputable in the industry. Gary set himself apart from many other steel executives by always practicing scrupulous honesty and fairness, earning himself the nickname "The Judge." But this did not prevent him from being a fierce and ruthless adversary to competitors. His decency also did not prevent him from being wildly successful, earning many millions at U.S. Steel. An early adherent to bonus systems, Gary developed the Stock Subscription and Profit Sharing Plan for his employees, helping to set an industry standard for decades to come. Never one to slack off or step down, Gary was still serving as chairman of the board of U.S. Steel at his unexpected death in 1927 at the age of 82.

Although not the first president of the United States Steel Corporation, Elbert H. Gary was the most famous and influential. Born in 1846 to a middle class family in Illinois, Gary began his career as a lawyer, only entering the steel industry after meeting J. Pierpont Morgan in 1898. Unlike Charles Schwab, Gary began his steel career in a management position, but he had comparable business talents and became equally reputable in the industry. Gary set himself apart from many other steel executives by always practicing scrupulous honesty and fairness, earning himself the nickname "The Judge." But this did not prevent him from being a fierce and ruthless adversary to competitors. His decency also did not prevent him from being wildly successful, earning many millions at U.S. Steel. An early adherent to bonus systems, Gary developed the Stock Subscription and Profit Sharing Plan for his employees, helping to set an industry standard for decades to come. Never one to slack off or step down, Gary was still serving as chairman of the board of U.S. Steel at his unexpected death in 1927 at the age of 82.  Thomas W. Lamont (September 30, 1870 – February 2, 1948) was a partner at J.P.Morgan & Co until 1943 when he became Chairman of the board. His personal papers, held at the Baker Library at the Harvard Business School, serve to defend J. Pierpont's role in the financial crisis in 1907 though most of his letters are unpublished. He speaks directly to Ida Tarbell's "Hunt For a Money Trust" and argues that the article “clearly shows the entire failure of critics to comprehend the point of view of the banking and business world”. He criticized Tarbell and other muckrakers for inaccurate reporting that "garbled" the words and testimony of J.Pierpont Morgan and other financiers at the Pujo hearings.

Thomas W. Lamont (September 30, 1870 – February 2, 1948) was a partner at J.P.Morgan & Co until 1943 when he became Chairman of the board. His personal papers, held at the Baker Library at the Harvard Business School, serve to defend J. Pierpont's role in the financial crisis in 1907 though most of his letters are unpublished. He speaks directly to Ida Tarbell's "Hunt For a Money Trust" and argues that the article “clearly shows the entire failure of critics to comprehend the point of view of the banking and business world”. He criticized Tarbell and other muckrakers for inaccurate reporting that "garbled" the words and testimony of J.Pierpont Morgan and other financiers at the Pujo hearings.  Charles Lindbergh (January 20, 1859 – May 24, 1924), the father of the famous aviator, was a member of the House of Representatives from Minnesota and the radical leader of the progressive Republicans within Congress. It was Lindbergh that began to stir up the “hue and cry” of the Money Trust Hunt in December of 1911, leading to the Pujo Committee investigation. As a vocal opponent of financial barons and money trusts, he wrote Banking and Currency and the Money Trust in 1913. In his book, he encouraged the general public to stand up and act against the banker class, led by J.Pierpont Morgan.

Charles Lindbergh (January 20, 1859 – May 24, 1924), the father of the famous aviator, was a member of the House of Representatives from Minnesota and the radical leader of the progressive Republicans within Congress. It was Lindbergh that began to stir up the “hue and cry” of the Money Trust Hunt in December of 1911, leading to the Pujo Committee investigation. As a vocal opponent of financial barons and money trusts, he wrote Banking and Currency and the Money Trust in 1913. In his book, he encouraged the general public to stand up and act against the banker class, led by J.Pierpont Morgan.  McClure's Magazine was an American monthly founded by S.S. McClure and John Sanborn Phillips in June, 1893. It was popular at the turn of the 20th century, featuring political and literary content. The magazine is credited with creating muckraking journalism. As noted in the New York Times book review "Society in Fiction" on March 30, 1913, the Sixty-First Second is a detective story regarding the highest circles of the high in New York city” including the influences of J. Pierpont Morgan during the 1907 crisis. It was published as part of a series in McClure's magazine in 1912 by Owen Johnson. Throughout the book, there are allusions to the Panic of 1907.

McClure's Magazine was an American monthly founded by S.S. McClure and John Sanborn Phillips in June, 1893. It was popular at the turn of the 20th century, featuring political and literary content. The magazine is credited with creating muckraking journalism. As noted in the New York Times book review "Society in Fiction" on March 30, 1913, the Sixty-First Second is a detective story regarding the highest circles of the high in New York city” including the influences of J. Pierpont Morgan during the 1907 crisis. It was published as part of a series in McClure's magazine in 1912 by Owen Johnson. Throughout the book, there are allusions to the Panic of 1907.  John Pierpont Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker who dominated corporate finance and industrial consolidation during his time. J.P. Morgan & Co. was founded in New York in 1871 as Drexel, Morgan & Co. by J. Pierpont Morgan and Philadelphia banker Anthony J. Drexel, which was named J. P. Morgan & Company in 1895. In bailing out the New York Stock Exchange, the Brokerage House Moore & Schley, Knickerbocker Trust Company, and Tennessee Coal & Iron Railroad Company, Morgan lost $21 million. Though he played a critical role in orchestrating the bail-out of many institutions during the crisis among other financiers at the time, he faced public criticism shortly afterwards. Along with other financial barons of the time, he was investigated in 1912 by the Pujo Committee.

John Pierpont Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker who dominated corporate finance and industrial consolidation during his time. J.P. Morgan & Co. was founded in New York in 1871 as Drexel, Morgan & Co. by J. Pierpont Morgan and Philadelphia banker Anthony J. Drexel, which was named J. P. Morgan & Company in 1895. In bailing out the New York Stock Exchange, the Brokerage House Moore & Schley, Knickerbocker Trust Company, and Tennessee Coal & Iron Railroad Company, Morgan lost $21 million. Though he played a critical role in orchestrating the bail-out of many institutions during the crisis among other financiers at the time, he faced public criticism shortly afterwards. Along with other financial barons of the time, he was investigated in 1912 by the Pujo Committee.  Under Adolph Ochs' leadership, The New York Times sought to provide impartial news—a radical undertaking in an era of yellow journalism—while also appealing to the political and business establishment. Ochs, an ambitious small-town newspaper publisher from Tennessee, purchased The Times when it was financially failing in 1896 for $75,000, almost entirely funded by loans from Wall Street investors ($25,000 alone came from J.P. Morgan). As he expanded the paper's news operation, he became even more indebted to investors. A conservative Democrat, Ochs valued his business contacts. However, his mission to deliver the news impartially sometimes conflicted with his desire to not alienate the elite that he had worked so tirelessly to join. During the Panic of 1907, The Times vividly portrayed the human side of the crisis as it unfolded. While it was clear that investors faced contingencies beyond their control, Times articles portrayed investors as exercising significant agency in their financial decisions.

Under Adolph Ochs' leadership, The New York Times sought to provide impartial news—a radical undertaking in an era of yellow journalism—while also appealing to the political and business establishment. Ochs, an ambitious small-town newspaper publisher from Tennessee, purchased The Times when it was financially failing in 1896 for $75,000, almost entirely funded by loans from Wall Street investors ($25,000 alone came from J.P. Morgan). As he expanded the paper's news operation, he became even more indebted to investors. A conservative Democrat, Ochs valued his business contacts. However, his mission to deliver the news impartially sometimes conflicted with his desire to not alienate the elite that he had worked so tirelessly to join. During the Panic of 1907, The Times vividly portrayed the human side of the crisis as it unfolded. While it was clear that investors faced contingencies beyond their control, Times articles portrayed investors as exercising significant agency in their financial decisions. Born in Pennsylvania in 1862 to a family of modest means, Charles M. Schwab started out as a laborer in one of Andrew Carnegie's steel mills and rapidly worked his way to the top of the industry, eventually becoming president of the United States Steel Corporation in 1901 and a close friend and business partner of Carnegie. Schwab is most famous for his leadership of the Bethlehem Steel Corporation beginning in 1903, during which time he brought the company from the brink of bankruptcy to being one of the largest and most profitable steel companies in the world. Schwab was a shrewd and masterful businessman, as well as infamous for his gambling antics in Monte Carlo. Schwab ruthlessly suppressed union activity and labor movements in his plants, but was also an early pioneer of the bonus system, giving even laborers financial rewards for exemplary work. Many people attribute much of the success of Bethlehem Steel to Schwab's bonus system, although it came under fire in the 1930s when the public discovered that company executives, including Schwab, were also benefiting from the bonus system––in the form of million dollar salaries and bonuses, setting precedents for other CEOs in decades to come. Hit hard by the stock market crash of 1929, Schwab died bankrupt in 1939, but his legacy in the steel world and beyond would not be forgotten.

Born in Pennsylvania in 1862 to a family of modest means, Charles M. Schwab started out as a laborer in one of Andrew Carnegie's steel mills and rapidly worked his way to the top of the industry, eventually becoming president of the United States Steel Corporation in 1901 and a close friend and business partner of Carnegie. Schwab is most famous for his leadership of the Bethlehem Steel Corporation beginning in 1903, during which time he brought the company from the brink of bankruptcy to being one of the largest and most profitable steel companies in the world. Schwab was a shrewd and masterful businessman, as well as infamous for his gambling antics in Monte Carlo. Schwab ruthlessly suppressed union activity and labor movements in his plants, but was also an early pioneer of the bonus system, giving even laborers financial rewards for exemplary work. Many people attribute much of the success of Bethlehem Steel to Schwab's bonus system, although it came under fire in the 1930s when the public discovered that company executives, including Schwab, were also benefiting from the bonus system––in the form of million dollar salaries and bonuses, setting precedents for other CEOs in decades to come. Hit hard by the stock market crash of 1929, Schwab died bankrupt in 1939, but his legacy in the steel world and beyond would not be forgotten.  Ida M. Tarbell (November 6, 1857 – January 6, 1944) was known as one of the leading “muckrakers” of her day. Earlier in her career she worked for McClure’s Magazine and published the controverisal book in 1904 The History of the Standard Oil Company, which was a negative expose of J.D. Rockefellar. She continued to pursue muckraking journalism, publishing "The Hunt For A Money Trust” in 1913 in The American Magazine.

Ida M. Tarbell (November 6, 1857 – January 6, 1944) was known as one of the leading “muckrakers” of her day. Earlier in her career she worked for McClure’s Magazine and published the controverisal book in 1904 The History of the Standard Oil Company, which was a negative expose of J.D. Rockefellar. She continued to pursue muckraking journalism, publishing "The Hunt For A Money Trust” in 1913 in The American Magazine.  Samuel Untermyer (March 6, 1858 – March 16, 1940) was a Democrat lawyer known most notably as the Congressional investigator during the Pujo Committee Hearings. In 1911 he delivered an address entitled, "Is There a Money Trust?" which led to an investigation by the Committee on Banking and Currency of the U.S. House of Representatives headed by Arsène Pujo the following year. From 1912 to 1913 he led the Pujo Committee to investigate financial barons such as J.Pierpont Morgan and George F. Baker. Untermyer argued for the regulation of the American financial system, specifically that of money trusts.

Samuel Untermyer (March 6, 1858 – March 16, 1940) was a Democrat lawyer known most notably as the Congressional investigator during the Pujo Committee Hearings. In 1911 he delivered an address entitled, "Is There a Money Trust?" which led to an investigation by the Committee on Banking and Currency of the U.S. House of Representatives headed by Arsène Pujo the following year. From 1912 to 1913 he led the Pujo Committee to investigate financial barons such as J.Pierpont Morgan and George F. Baker. Untermyer argued for the regulation of the American financial system, specifically that of money trusts. Originally born in Germany to a prominent banking family, Paul Warburg settled in the United States following his marriage to Nina Loeb, daughter of a founder of Kuhn, Loeb & Company, a prominent New York-based investment bank. Warburg gained further renown through his numerous writings in support of a central banking system in the United States, beginning as early as 1907 with “Plan for a Modified Central Bank,” which was published shortly after the Panic of 1907. Warburg largely masterminded the Aldrich Bill, the blueprint of the 1913 Federal Reserve Act, as well as the creation of the National Citizens’ League to garner popular support for banking reform.

Originally born in Germany to a prominent banking family, Paul Warburg settled in the United States following his marriage to Nina Loeb, daughter of a founder of Kuhn, Loeb & Company, a prominent New York-based investment bank. Warburg gained further renown through his numerous writings in support of a central banking system in the United States, beginning as early as 1907 with “Plan for a Modified Central Bank,” which was published shortly after the Panic of 1907. Warburg largely masterminded the Aldrich Bill, the blueprint of the 1913 Federal Reserve Act, as well as the creation of the National Citizens’ League to garner popular support for banking reform.