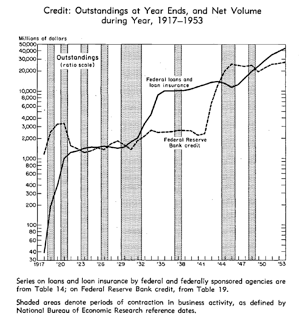

The purpose of the workshop is to explore the extension of federal credit in a historical perspective and consider today's realities within the context of longstanding debates over public sector risk management, including, for example, federal loan insurance and credit. The footprint of the federal government is large, and permeates all aspects of our economy. Understanding and managing these exposures, both direct and indirect, has been an area of interest for historians, economists, legal scholars and policymakers for many decades.

The topic of federal financial exposure raises a number of questions: How has the concept of public risk changed over time? How should the contingent liabilities of the government and taxpayers be defined? How do we understand the government's role as the lender of last resort in contrast to the government's ongoing role in addressing financing gaps in certain sectors of the economy and for certain portions of the population? How have federal authorities represented the size and composition of the U.S. balance sheet, and how have they managed its assets and liabilities, actual and contingent? How do expansions and contractions in federal lending fit within our broader understanding of macro-economic cycles?

Please do not hesitate to contact Jennifer Nickerson with any questions.

nickers@fas.harvard.edu

617-496-4869